IRA / March 2, 2023

The Inflation Reduction Act Has Tax Credits and Rebates for San Diego and San Diego County Homeowners

You may have heard about the recently signed Inflation Reduction Act (IRA), which was created to provide significant investment to reduce the effects of US carbon pollution in the face of the current climate crisis. San Diego and San Diego County homeowners can benefit from the Inflation Reduction Act by making energy efficient upgrades in their homes, which can lead to tax credits and rebates as well as lower energy bills.

How much you can save with IRA tax credits and rebates?

If you’re a homeowner in San Diego or San Diego Country, you could potentially save up to $17,000 between tax credits and rebates included in the IRA by making qualifying energy-efficient HVAC upgrades to your home, in addition to saving on your utility bills. Use the saving calculator from Rewiring America to estimate your potential savings from energy-efficient changes to your home. If you’re thinking about making some home upgrades this year, give the professionals at Mauzy a call at 619-357-6016 to see what your best options might be.

IRA Tax Credits

With tax season approaching, homeowners are looking for ways to save money on their taxes. One of the most significant benefits of the Inflation Reduction Act is the tax credits available for homeowners who purchase and install energy-saving upgrades to their homes, such as energy-efficient doors and windows, air conditioners, furnaces, heat pumps, and more. Everyone likes the chance to save some money on their taxes, and the IRA built-in tax credits can help you do just that.

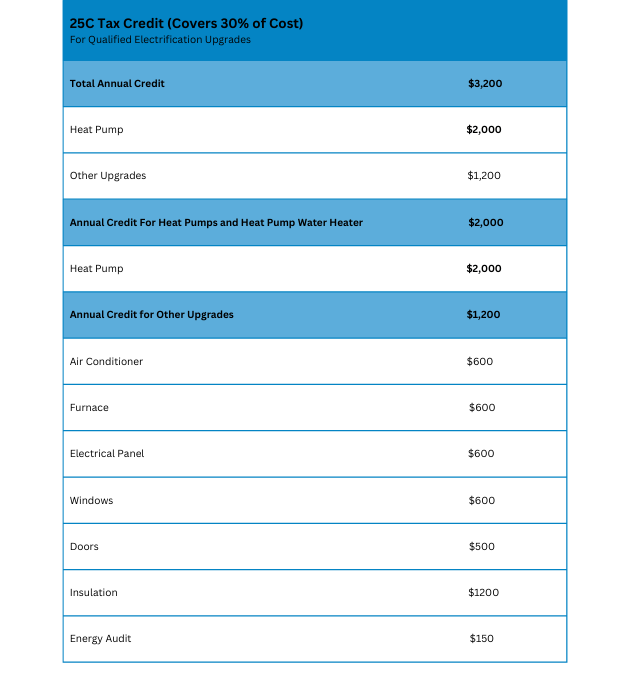

25C Energy Efficient Home Improvement Tax Credit

The Energy Efficient Home Improvement Tax Credit included in the Inflation Reduction Act is an expansion of the 25C tax credit, which allows homeowners to deduct up to 30% of the cost of certain energy-efficient home improvements, up to $3,200 per year. To see which energy efficient appliances and upgrades qualify for tax credit, see the chart below.

IMPORTANT NOTE: These tax credits are not up-front savings on the initial purchase of new equipment or appliances. Rather, they are factored into your tax credit amount when it’s time to file.

The qualifying costs for these items include the equipment itself, installation, and labor costs. To qualify for the 25C tax credit, any new appliance installations and/or upgrades you make to you home must meet certain requirements. Our team at Mauzy will guide you to qualified equipment that will help you save on your utility bills and will be eligible for the tax credit—give us a call at 619-357-6016. Check out this chart to see how much you can save annually on your utility bills!

Find full details of the Energy Efficient Home Improvement Tax Credit and eligible appliances here.

IRA 25C Tax Credit Eligibility

All San Diego and San Diego County homeowners are eligible for the Energy Efficient Home Improvement Tax Credit, which can be applied to any new qualifying equipment you have installed or upgrades you make after January 1, 2023. However, it’s important to remember that there is an annual cap of $1200 per household per year (excluding heat pumps, which have a cap of $2000), and a total cap of $3200. This is the time to make any planned home improvements and take advantage of these tax savings!

Contact the professionals at Mauzy at 619-357-6016 for expert help and guidance on products and installation.

Claiming your tax credits

Our experts at Mauzy will provide you with documentation on your new qualified energy efficient upgrades to claim your tax credits after you have completed your installation. Give us a call at 619-357-6016.

To find out just how much money you can save on your taxes through these credits, use this IRA savings estimation calculator.

IRA rebates for home upgrades

Another financial incentive to help San Diego and San Diego County homeowners make more energy efficient upgrades are HEEHRA and HOMES rebates. While the tax credits are available now, these rebates will be ready to apply to purchase toward the end of 2023.

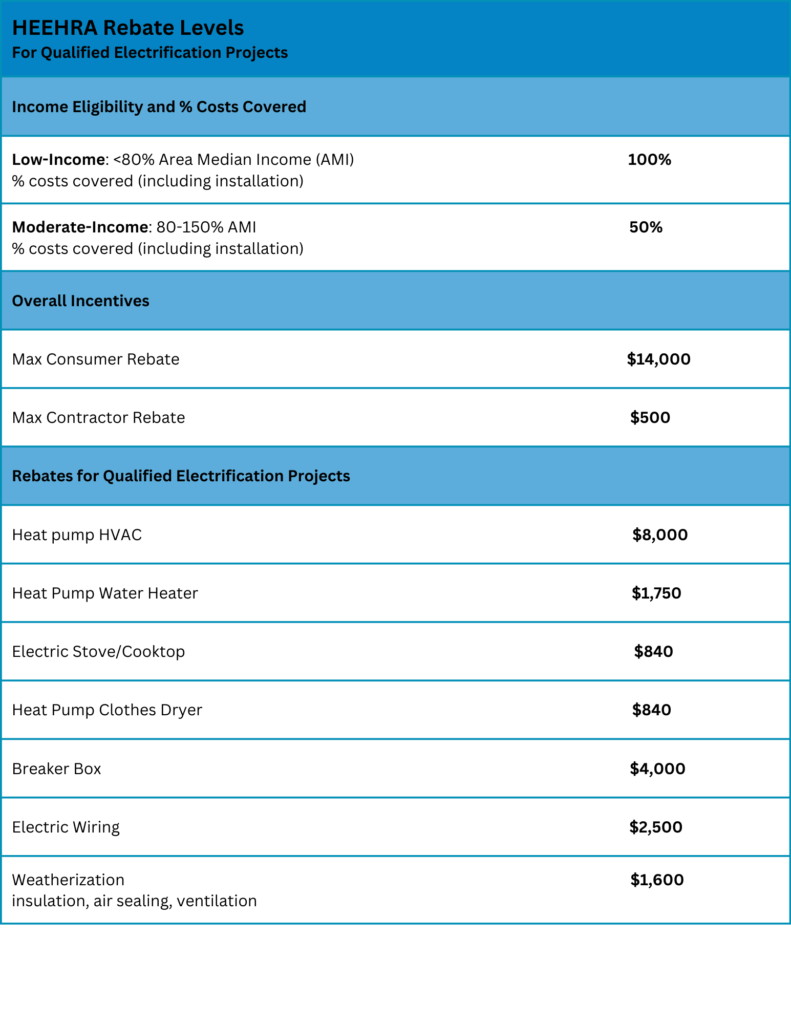

High Efficiency Electric Home Rebate Act (HEEHRA)

The High Efficiency Electric Home Rebate Act offers as much as $14,000 per year in rebates and covers up to 100% of electrification project costs for low- to moderate- income households who want to install new qualifying efficient electric appliances. Households must fall under the 150% area median income to qualify for the HEERHRA rebate program. Rebates will be available later in the year. Check out the chart below for details on available rebates.

Most of the HEEHRA rebates will be applied when you purchase the appliance. If you have questions about eligibility or to see if you qualify for these rebates, be sure to contact our professionals at Mauzy at 619-357-6016 for advice in purchasing and installing any of these new appliances.

Home Owner Managing Energy Savings (HOMES) Rebate Program

The HOMES rebate program is a whole home, performance-based rebate that reimburses homeowners for whole-house energy improvements to encourage energy savings. This means that when you install equipment like heat pumps and make electrical upgrades that reduce your overall home energy use, you will earn more money back.

Households that cut energy usage by 20%-35% can save $2000 to $8000 with the HOMES program. The more energy you save, the bigger the rebate!

All households qualify for the HOMES rebate. However, the rebate is doubled for low- to moderate-income homeowners, and the program will cover up to 80 percent of project costs. Most of the available rebates offered by the Inflation Reduction Act will be available starting near the end of 2023. The timing of these for San Diego and San Diego County homeowners depends on California guidelines and the Department of Energy regulations, so be sure to check with the experts at Mauzy at 619-357-6016 to see if rebates are available when you’re ready to purchase.

A Cleaner Future

The Inflation Reduction Act was designed to assist individuals in mitigating the costs associated with excessive use of fossil fuels, mitigating pollution, and promoting cleaner energy alternatives nationwide. People residing in any region of the United States can lower their energy expenditures, minimize their tax burden, and obtain cashback by purchasing energy-efficient, environmentally friendly appliances and electrical systems. We understand that it can be overwhelming to grasp all the details.

If you have any inquiries concerning your potential home upgrades or the Inflation Reduction act our professionals at Mauzy would be delighted to assist you. Give us a call at 619-357-6016.

Frequently Asked Questions

How are Inflation Reduction Act tax credits and rebates different?

The tax credits included in the IRA reduce your tax liability and are claimed on your tax return after the you make upgrades to your home. The IRA provides customers with an annual tax incentive of up to $3200 with the 25C tax credit, which will be applied when you file your taxes. For example, this year you can install a new heat pump air system and next year you can upgrade your home with a new heat pump water heater, and both will be eligible for the tax credit.

Rebates are a type of upfront savings that are applied at the point of sale. It is up to the service provider to handle the paperwork and process the rebate.

Are rebates retroactive?

State energy offices has not made it clear whether rebates will be retroactive, it will be at the discretion of each state.

Can I use rebates and tax credits for the same projects?

You cannot use the HOMES and HEERHA rebates for the same single upgrade, but they can be combined for separate upgrades. For example, you can use the HEERHA to upgrade your heat pump air system and HOMES to upgrade your water heater.

However, you can get HEEHRA and HOMES rebates and still claim the tax credits outlined in the Inflation Reduction Act.

How do I get started?

The trusted San Diego and San Diego County experts at Mauzy know the ins and out of the Inflation Reduction Act incentives and will provide all the information you need to receive the tax credits or rebates you qualify for, from heat pumps to electrical upgrades to energy efficient plumbing.

Contact us today at 619-357-6016 to make an appointment or ask any questions you may have about how you can take advantage of the Inflation Reduction Act.

Read more about the IRA 25C Tax Credit and how you can save.

Find out how you can save on heat pump and HVAC upgrades with the Inflation Reduction Act tax credits and rebates.

*Disclaimer: Mauzy Heating, Air & Solar does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. While we make every effort to provide accurate and up-to-date information about available rebates and tax credits, it is ultimately the responsibility of the homeowner to research and verify eligibility for any available incentives. In addition, please note that the information provided by Mauzy Heating, Air & Solar regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. Mauzy Heating, Air & Solar is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.