IRA / March 2, 2023

Save on HVAC upgrades and heat pumps in San Diego and San Diego County with the Inflation Reduction Act

The Inflation Reduction Act (IRA), signed in August 2022, offers tax credits and rebates that can help San Diego and San Diego County homeowners make energy-efficient upgrades. You can lower your carbon footprint in addition to saving money on heat pumps and other energy-efficient heating and cooling home upgrades.

The financial incentives included in the Inflation Reduction Act will help San Diego and San Diego County homeowners save money on their bills by reducing the amount of energy they use, all while promoting a cleaner and healthier indoor air environment at the same time.

Save on heat pumps and HVAC with tax credits and rebates

If you have a combination furnace and air conditioning system, consider opting for a heat pump for your home. Heat pumps are more energy efficient since they use just one piece of equipment.

The IRA offers tax credits that you can take advantage of now when you make the change to an energy-efficient heat pump. In addition to the immediate tax discount, heat pumps also save the average American homeowner around $10,000 over 15 years, and even more if your home currently uses baseboard heating, an electric furnace, propane, or fuel oil.

The IRA tax credits are an extension of the 25C tax credits and went into effect January 1, 2023. The act also includes rebates that can be applied to equipment and installation purchases, which will be available toward the end of 2023.

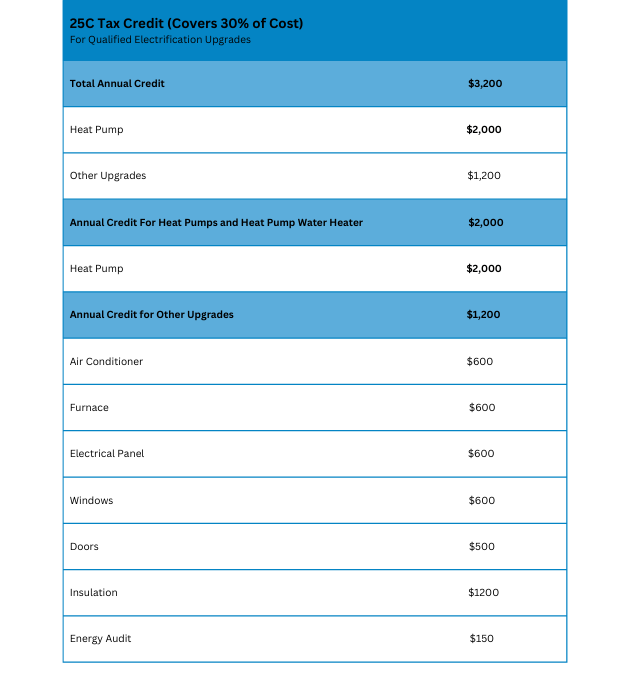

See the chart below for information on tax credits you may be eligible for:

Appliances that may be eligible for IRA tax credits

When you make certain qualifying hardware updates to make your home more energy efficient, you may be eligible for tax credits on purchases and installation.

Heat Pumps

Heat pumps provide homeowners with an energy efficient option to your traditional two-unit air conditioner and furnace. Heat pumps are powered by electricity and transfers heat using refrigerant. This means heat pumps can pull heat from cold air outside to warm your space and pull heat out of your warm air indoors to cool the temperature in your home being much more energy efficient than a furnace or air conditioner, or a combination of the two. Heat pump systems can have many advantages:

- It saves you money and space since you only need one unit to cool and warm your house

- Heat pumps require less maintenance because you will only need to schedule one maintenance check per year

- Your carbon footprint is smaller since no fuel is needed.

- You save money on your energy bill every month.

The HVAC experts at Mauzy can give you all the information you need to replace your current system with an energy-efficient heat pump. Give us a call at 619-357-6016.

Air Conditioner

For some households, air conditioners may be a better fit than heat pumps for your home. Today’s air conditioners use a new kind of coolant compared to older units and are required to meet certain energy efficiency standards. Energy efficient units can reduce carbon pollution and help you make significant savings on your energy bills. Ask the HVAC experts at Mauzy what is recommended for homeowners in San Diego and San Diego County–give us a call at 619-357-6016.

Furnace

An energy-efficient furnace may make sense for some San Diego and San Diego County households, depending on various factors like the structure of the home. The IRA tax credit can save you up to $600 on a furnace upgrade. Give Mauzy a call at 619-357-6016 to have a certified technician recommend what’s best for your home.

25C Tax Credits for HVAC and Heat Pumps

As part of the Inflation Reduction Act, some existing tax credit and deduction programs were extended.

Energy Efficiency Home Improvement (25C) Tax Credit

The Energy Efficiency Home Improvement (or 25C) tax credit has been increased to cover 30% of the total cost of qualifying new energy efficient qualified systems. This tax credit went into effect on January 1, 2023.

When you schedule a heat pump installation or HVAC upgrade with Mauzy in 2023 you will be able to deduct 30% of your total costs when filing your taxes, capped at $3,200. If you install a heat pump, you can deduct up to $2,000 on your taxes.

Inflation Reduction Act Rebates for HVAC and Heat Pumps

The Inflation Reduction Act also includes rebates for homeowners who want to purchase and install heat pumps or updated HVAC systems. Note that these rebates will be available toward the end of 2023.

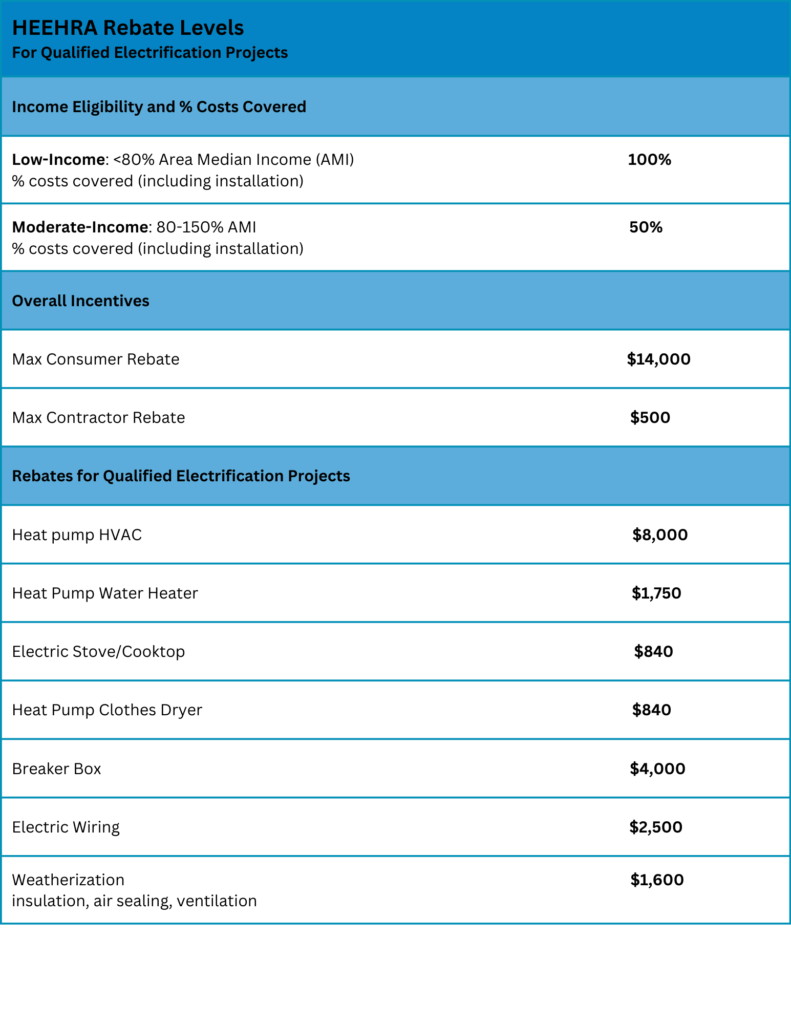

High-Efficiency Electric Home Rebate Act (HEEHRA)

The High-Efficiency Electric Home Rebate Act (HEEHRA) offers up to $14,000 per year in discounts on the purchase of equipment for electrical projects.

HEEHRA discounts are capped at 50% of qualifying costs for a household earning between 80% and 150% of area median income. Households earning less than 80% will see 100% of coverage of qualifying costs (up to $14,000) through HEEHRA.

Home Owner Managing Energy Savings (HOMES) Whole House Rebate

The HOMES rebate is a whole-home, performance-based rebate. When you make home upgrades that save 20%-35% more energy, you can save up to $8000 with the HOMES rebate. The more energy you save, the more money you will earn back!

All San Diego and San Diego County homeowners qualify for the HOMES Rebate, with low- and medium-income households eligible for higher amounts.

Contact Mauzy at 619-357-6016 today to schedule an appointment and see how you can save money with a heat pump or other HVAC upgrade and have this rebate apply to you.

HEEHRA and HOMES Rebate Timelines

Like the HOMES Rebate program, funds for the HEEHRA will become available later in 2023. The exact timeline and date are not known yet and are dependent on Department of Energy guidelines and state implementation. It is up to individual states to determine if HEEHRA rebates will be retroactive. Low-income households will receive larger and more accessible up-front discounts from HEEHRA than the HOMES rebate.

NOTE: The HOMES rebate and the HEEHRA rebate can’t be combined, but San Diego and San Diego County homeowners may claim both the rebates and the Inflation Reduction Act tax credits.

Contact Mauzy at 619-357-6016 and schedule an appointment to see how you can upgrade your house and save with the HEEHRA or HOMES rebates.

Inflation Reduction Act Quick Facts

The Energy Efficiency Home Improvement 25C Tax Credit that went into effect on January 1, 2023, will cover up to 30% of the total cost and you can save up to $3200 if you install a heat pump or energy efficient system in your home today.

The HEEHRA rebate allows middle- and low-income households to earn up to $14,000 in rebates for electrification home upgrades, but this will not be going into effect until end of 2023.

The HOMES rebate is a whole-home, performance-based rebate, meaning the more energy you save by making certain home upgrades, the more money you receive back in rebates. You can save up to $8000 in rebates depending on your income level and will go into effect at the end of 2023.

Mauzy has the answers to all your heat pump, HVAC, and Inflation Reduction Act (IRA) questions

Our trusted experts are well-versed in the details of the IRA rebates and tax incentives and can guide you to the right choice for heat pumps, HVAC upgrades, and other options to cool and heat your home. Contact Mauzy today at 619-357-6016 to make an appointment for a home inspection or assessment, or to ask us questions you may have about how you can take advantage of the Inflation Reduction Act.

Read more about what the Inflation Reduction Act tax credits and rebates mean for you.

Find out more about the IRA 25C tax credit.

*Disclaimer: Mauzy Heating, Air & Solar does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. While we make every effort to provide accurate and up-to-date information about available rebates and tax credits, it is ultimately the responsibility of the homeowner to research and verify eligibility for any available incentives. In addition, please note that the information provided by Mauzy Heating, Air & Solar regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. Mauzy Heating, Air & Solar is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.